U.S. border patrol captured Chinese gang leader set up in Vancouver to launder funds from Macau casinos

VANCOUVER, Canada — Tujie Lai, a Chinese national and alleged transnational gangster based in Vancouver, wanted on an Interpol Red Notice for violent loan-sharking crimes including kidnapping and extortion, is now at the center of a complex web of Chinese casino operations and underground banking transactions.

He is accused of laundering millions in wire transfers from entities in Asia, including through his child’s bank account, while operating under the radar of Canadian regulators tasked with detecting money laundering in casinos, banks, and real estate.

But Lai seems to have made one critical mistake.

His attempt to evade U.S. border patrol officers after crossing the border illegally put him into the hands of American law enforcement, who submitted him to Canadian border officials. This, according to The Bureau’s analysis, prompted intensified scrutiny in Canada of a glaring paper trail that Lai and his wife, Wenyi Chen, also a Chinese national, left behind across multiple sectors in British Columbia.

According to a civil forfeiture claim filed in the Supreme Court of British Columbia, Canadian authorities are now pursuing CAD $880,000 in bond money tied to Lai and Chen, citing it as the proceeds of unlawful activity.

A review of Lai's case suggests his occupation as a self-employed individual and Chen’s role as a homemaker fit into the broad indicators of money laundering activities in Vancouver’s real estate market revealed in previous journalistic investigations by The Bureau — and patterns identified by experts such as Andy Yan, a prominent Vancouver urban planner.

The case details — Lai’s apparent stature within Chinese underground banking networks and his free use of Vancouver’s financial system — seem to align with the opinion of U.S. investigators such as David Asher, who believe America’s banking system is being manipulated in fentanyl-cash laundering schemes by “command and control” networks in Toronto, and also British Columbia.

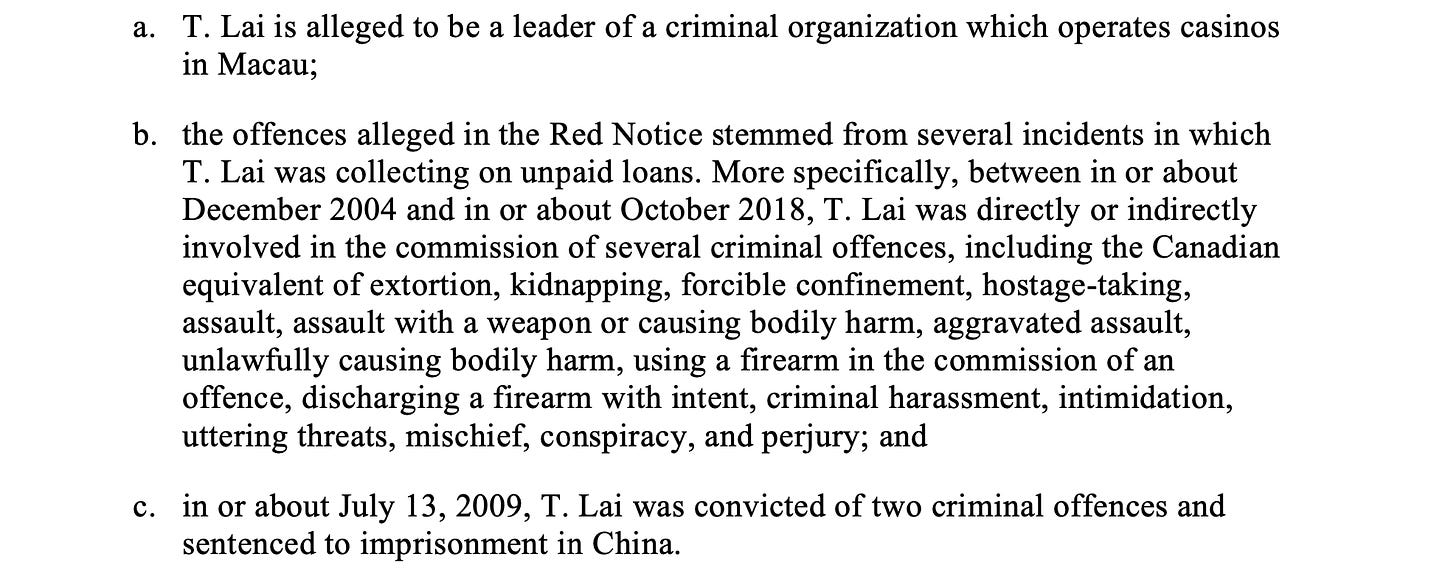

Lai’s journey from Macau to Vancouver is marked by a violent history tied to his alleged criminal organization. According to Interpol’s Red Notice, Lai’s network in Macau was deeply involved in loan-sharking and junket operations within the region’s casinos.

The sector is infamous for loan-sharking operations and high-roller gambling.

Junkets, most often tied to powerful international triad organizations such as the 14K, Big Circle Gang, and Sun Yee On, according to United States and Australian investigators, enable ultra-wealthy Chinese businessmen, often connected to Chinese Communist Party elites, to clandestinely move funds out of China and into other nations.

While these networks prey on gamblers, offering high-interest loans and enforcing repayment through violent means when debts go unpaid, they are also suspected of serving strategic objectives of the Chinese Communist Party, according to sprawling junket investigations in Australia that implicated “VIPs,” including a cousin of President Xi Jinping, according to Sydney Morning Herald.

Between 2004 and 2018, Tujie Lai allegedly orchestrated a series of violent crimes linked to his Macau casino junket collection efforts. These incidents included kidnapping, extortion, forcible confinement, hostage-taking, and multiple forms of assault, including with weapons and firearms. Lai’s tactics extended to criminal harassment, intimidation, and uttering threats, making him a feared figure in Macau’s casino underworld. In July 2009, he was convicted of two criminal offenses in China and sentenced to prison.

Whether he was actually jailed isn’t clear. And how Lai immigrated to Canada and set up his global money laundering networks with an Interpol Red Notice hanging over his family is also a mystery, but not an uncommon story in Vancouver.

Lai and his wife transferred CAD $12 million from Macau and Hong Kong into Canada, according to Canadian investigators. Additionally, they revealed having CAD $100 million in assets in China.

The junket business evidently provided a steady flow of cash, and clients in China seeking to move their funds through Canadian banks and casinos.

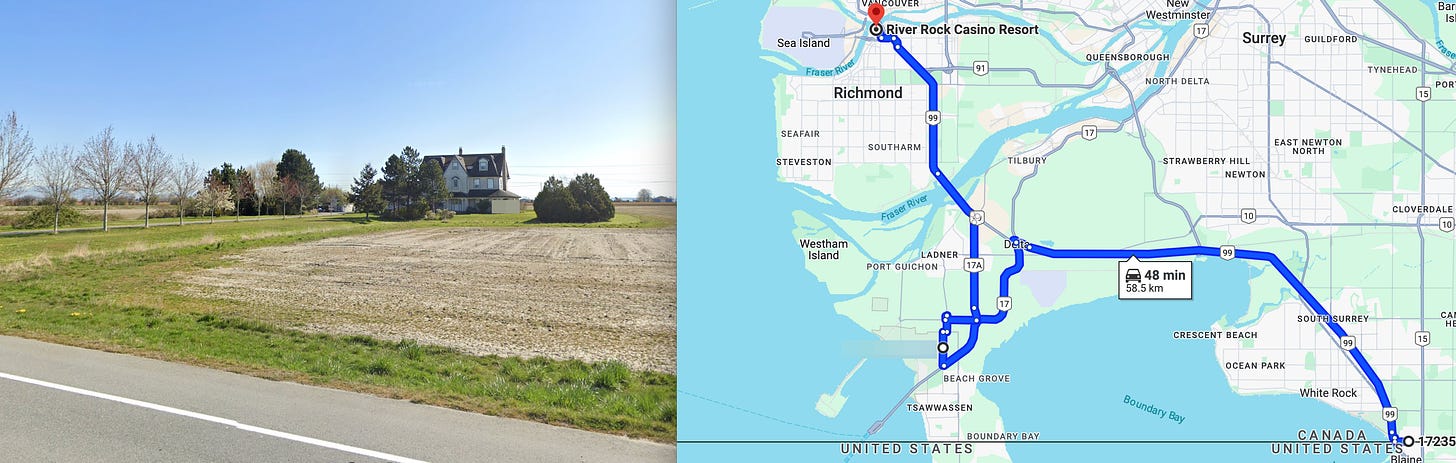

While in Vancouver, Lai expanded his operations, using local casinos as conduits for laundering proceeds of his criminal activities. According to authorities, Lai frequented several Lower Mainland casinos, including Richmond’s River Rock Casino, where he routinely conducted high-value transactions.

As the leader of a criminal organization operating casinos in Macau, Lai was well-versed in the tactics needed to hide illicit funds. His activities extended beyond the casinos, with significant sums of money being moved between accounts both locally and internationally, and funds nominally exported by legitimate Asian businesses.

Lai and his wife, Wenyi Chen, owned a 3,800-square-foot home nestled in the middle of farmland in Delta, a suburb near the U.S. border. The home’s secluded location — also near B.C. casinos and port facilities with links to Chinese Triad tycoons, according to The Bureau’s law enforcement sources — suggested an ideal base of operations for Lai’s activities, allowing him to live quietly while orchestrating his transnational criminal enterprise. The proximity to the U.S. border also facilitated his illicit movements across international lines, such as the incident in July 2019, when Lai fled from U.S. Border Patrol after crossing the border illegally.

Money Flow Through Accounts

Between October 2018 and February 2020, Wenyi Chen received CAD $1.84 million and USD $20,000 in wire transfers into her bank accounts, originating from Tujie Lai and various companies in Hong Kong and Singapore.

Simultaneously, Lai himself received CAD $3.41 million between November 2018 and June 2019 in wire transfers from businesses and individuals in Hong Kong and China.

These transactions illustrate the complex international nature of Lai’s money laundering scheme, with funds being funneled through a network of accounts in different countries. On June 7, 2019, Chen deposited CAD $4 million into the bank account of their child, and just ten days later, on June 17, the entire sum was transferred out to an unknown account at the same bank, further obscuring the paper trail.