Money laundering from China into Canada increasingly used banks and homes after COVID-19: FINTRAC

With casino closures during pandemic Canada's financial watchdog observed more wire transfers from Hong Kong into real estate, law firms, securities

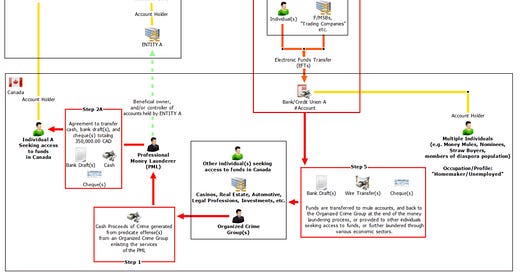

Fintrac, Canada’s anti-money laundering watchdog, is reporting that underground banking schemes involving Chinese crime groups and Canadian diaspora communities rapidly evolved with casino closures during the pandemic, and sophisticated, professional money launderers are increasingly flooding international wire transfers into banks, law offices and property development in Canada.

Fintrac’s findings raise concerns that Canada’s housing market is being used widely and increasingly in these schemes, and prompt questions about how this criminal activity is impacting prices in the nation’s already overheated real estate.

Fintrac’s new report stems from a study of criminal infiltration of Canadian banks and B.C. government casinos, which prior to 2019, focused on the laundering of bank drafts into casino accounts.

Called Project Athena, the joint-study from Canadian organized crime policing units and Fintrac — which has voluminous financial transaction data across many sectors — found that Chinese transnational crime groups were easily using casinos on Canada’s West Coast.

But Fintrac expanded Project Athena’s scope, the agency says, because investigators discovered China-based crime groups were increasingly penetrating the national economy, laundering funds through Canada’s real estate, securities and stock markets, and automotive industry.

These transactions bring together the interests of transnational criminals seeking to launder drug money collected worldwide, and citizens in diaspora communities, through the use of professional underground banks, which enable people in Canada to import funds from China, skirting Beijing’s strict currency-export controls, through complex schemes that often blend legitimate and illegitimate sources of funds.