"Fake Chinese income" mortgages fuel Toronto Real Estate Bubble: HSBC Bank Leaks

“I found out a huge mortgage fraud showing borrowers with exaggerated income from one specific country, China": The Bureau investigates whistleblower docs

The whistleblower, a Canadian business school graduate, was staggered by the suspicious home loans he discovered in 2022 when he joined a mortgage approval team in a small HSBC branch on the outskirts of Toronto.

He knew of suspicions surrounding Chinese capital in British Columbia real estate, but had never witnessed shady lending while working at an HSBC branch in Campbell River, a bucolic town on the coast of Vancouver Island.

When he arrived at HSBC’s bank in Aurora, an affluent suburb north of Toronto, he discovered explosive growth in home loans to Chinese diaspora buyers during the Covid-19 pandemic.

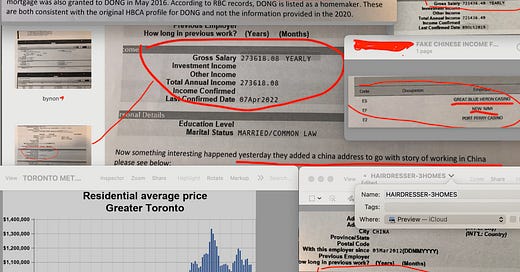

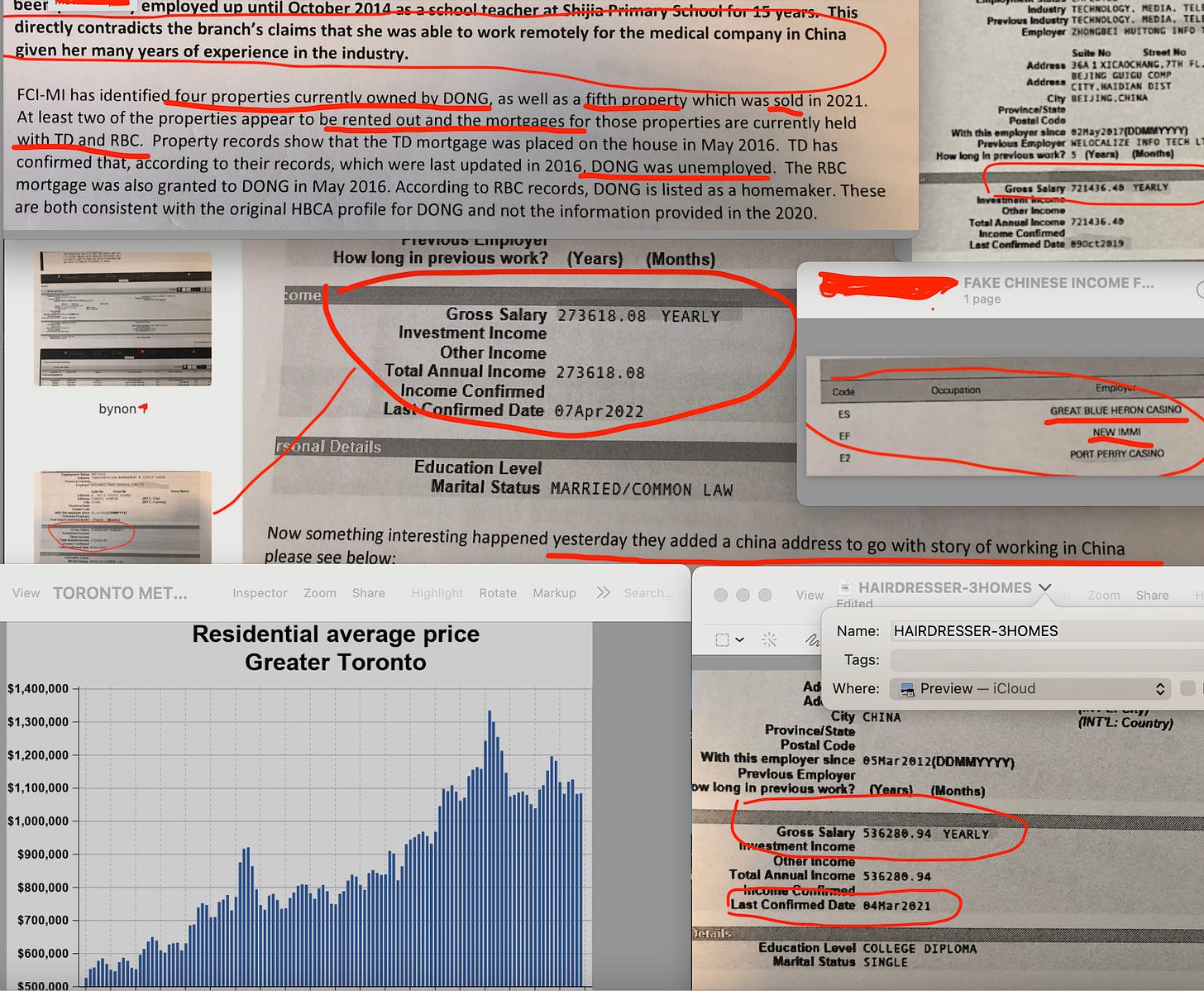

Chinese migrants living across Toronto were obtaining mortgages from HSBC while supposedly earning extravagant salaries from remote-work jobs in China. In one example, an Ontario casino worker that owned three homes also claimed to earn $345,000 in 2020 analyzing data remotely for a Beijing company.

Before joining HSBC Canada, the whistleblower had studied fake-income mortgage frauds for his Business Masters degree at Vancouver Island University. After arriving at Aurora in February 2022, while digging into the branch’s loan books and interrogating his colleagues, he made mind-blowing assessments.

Since 2015, the whistleblower concluded, more than 10 Toronto-area HSBC branches had issued at least $500-million in home loans to diaspora buyers claiming exaggerated incomes or non-existent jobs in China.

These foreign-income scams spiked during the pandemic, the whistleblower believed, because borrowers could somewhat plausibly claim to be working remotely in other countries while riding out Covid-19 in Canada.

While a small bank of Aurora’s size was expected to issue about $23-million in residential loans every year, this branch had shovelled out $88-million in mortgages in 2020, according to the whistleblower, and over $50-million in 2021.