CCP ‘Golden Shares,’ Toronto Laundering Command, Mexican-Chinese Cash Collectors, and TD Bank: Inside the Global Fentanyl Trade

In an exclusive, a U.S. government expert reveals Beijing party officials own fentanyl-exporting firms—and says CBP northern border data exclude “hundreds of other entities seizing drugs from Canada"

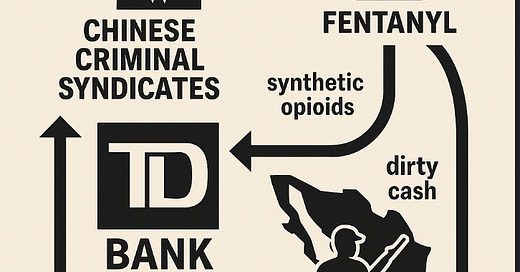

WASHINGTON — In an exclusive, deeply detailed interview, a senior U.S. government expert with oversight of thousands of high-level transnational crime investigations—from El Chapo to more sophisticated Chinese crime lords, including billionaires with direct ties to the Chinese government, strategically based in Mexican and Canadian cities—has revealed unprecedented insights into Canada’s pivotal role in the People’s Republic of China’s global fentanyl trafficking and money laundering apparatus.

The expert’s account includes sensitive findings from the TD Bank fentanyl laundering probe, a case with sweeping implications that some in Washington believe could ultimately trigger class-action lawsuits from thousands of grieving families.

In perhaps the most explosive revelation, the expert described a U.S. government investigation uncovering Chinese Communist Party members holding “golden shares” in fentanyl-exporting chemical companies.

Speaking on condition of anonymity due to the sensitivity of their position, the expert described to The Bureau the architecture of what they called a highly sophisticated criminal enterprise with warlike capabilities—an operation with documented ties to the Chinese state and tentacles spanning multiple continents. Key figures such as Tse Chi Lop, Xizi Li, and Zhenli Ye Gon—names that resonate inside federal intelligence and counter-narcotics circles—have helped construct a resilient command structure for the global fentanyl economy, coordinating logistics and laundering from urban strongholds including Toronto and Mexico City.

These cities, the expert said, serve as operational headquarters for a transnational machine that moves synthetic opioids by the ton and launders billions in dirty cash. One key financial artery: Toronto-Dominion Bank.

According to the expert, investigators have traced how Chinese financiers operating in Mexico and Canada forged contracts with both Mexican cartels and Chinese Triads. These deals go far beyond distribution—they underwrite the entire fentanyl economy, supplying upfront capital for precursor chemicals, offering financial guarantees, and embedding insurance-like recovery mechanisms that ensure the supply chain runs uninterrupted. Once the fentanyl reached street corners and cash began circulating, the operation turned to an unexpected workforce: Chinese international students in the United States, enlisted to move funds and help launder billions.

Working on student visas, these young couriers were dispatched to discreetly collect bulk cash from cartel-linked warehouses. From there, the students carried the money—tightly packed in duffel bags—to TD Bank branches throughout the Tri-State area of New York, New Jersey, and Connecticut. The process, the expert said, was clean, compartmentalized, and repeated at scale.

In a staggering disclosure, the expert explained that fentanyl proceeds don’t simply vanish into cartel and Triad bank accounts. The Chinese brokers who handle the funds carve out their own lucrative share—laundering “points” that are then parlayed into a sprawling, hidden economy. That skim alone, the expert said, is vast: loaned out and reinvested across nearly every sector of the global marketplace—from real estate developments and shell-company startups to nail salons, massage parlors, and illicit manufacturing hubs that, over time, blur into the legal architecture of China’s globalized economic footprint.

At the top of it all—overseeing a global structure that supplies fentanyl pill presses, precursor chemicals, dyes, labor, and the laundering infrastructure to move trillions of dollars over decades—sits Beijing.

“China is on both ends of the drug trade,” the expert said. “They supply the chemicals, they control the laundering, and at the very top, you’ve got People’s Republic of China officials.”

According to the expert, the intelligence points toward senior Chinese government officials maintaining financial and operational links to firms producing synthetic drug precursors, as well as entities managing the flow of laundered proceeds.

“We’ve identified Chinese Communist Party members holding golden shares in the chemical companies shipping precursors out of China,” the source said. “So you have known CCP members on the board of the fentanyl enterprise. You have known locations and chemical companies or even production of the fentanyl in prisons owned by the People’s Republic.”

For some in Washington, the evidence is powerful enough to warrant a future designation of the Chinese Communist Party as a transnational drug trafficking organization—and to trigger sanctions targeting top leaders in Beijing.

Responding to recent controversy sparked by statements from Canadian officials and reporting by The Globe and Mail, the expert bluntly rejected claims that Canada’s role in the North American fentanyl crisis is minimal—an argument based on low U.S. Customs and Border Protection (CBP) seizure numbers along the northern border.

That metric, the expert said, is dangerously misleading.

CBP’s northern data, they explained, does not account for seizures made by the DEA, FBI, ICE, state and local police, or forces investigating inland trafficking routes tied directly to Chinese transnational networks operating out of Canada. Investigations have documented extensive seizures of fentanyl and black-market marijuana flowing into the U.S.—particularly into the vast Tri-State region, where Chinese organized crime groups move effortlessly between Ontario and upstate New York, sharing pill press infrastructure and money laundering pipelines.

“The border issue as far as fentanyl, I remember someone reported that it was 1 percent of all the fentanyl seizures, but that's just not true,” the senior U.S. enforcement overseer said. “That was Customs Border Protection’s number that they seized. It does not include the number of all the other federal agencies that work drugs on the border. It did not include the metrics from the state and local police agencies that work the border. So you're talking about hundreds of other law enforcement entities that are also seizing drugs coming down from Canada.”

In one of the most detailed confirmations yet, the source stated plainly: while major U.S. banks have also been exposed to Chinese money laundering brokers now dominating global financial flows for Latin American cartels, TD Bank stood out.

What made TD unique, the expert said, was its physical footprint and deep integration with Chinese community networks in both Toronto and New York—an infrastructure that proved ideal for laundering massive volumes of fentanyl cash.

It’s a sensitive conclusion, now circulating at the highest levels in Washington: that certain cultural norms within diaspora communities—such as large, informal cash transactions—have inadvertently been weaponized by transnational criminal networks. And in Canada, where financial institutions operate in cities with comparatively higher concentrations of Chinese diaspora populations, those practices appear to have been tolerated, if not outright normalized, by business managers at senior levels.

“Imagine if you’ve got a 21-year-old showing up with $3 million, $4 million, $5 million, $6 million—and you have multiple students now going to the same branch, dropping off millions of dollars,” the expert said. “There’s not the same sort of cultural stigma with a bag of cash attached to a Chinese person. It’s like, ‘Okay, well, that’s believable.’ Whereas if I did that, it would set off alarms everywhere, right?”

The following is Part 1 of a two-part series based on multiple interviews with a senior U.S. government figure. This installment focuses on the operational and financial architecture of Chinese-linked transnational fentanyl networks. Part 2, publishing tomorrow, examines the broader geopolitical stakes of the U.S. investigation and President Trump’s disruptive tariff offensive. The transcript has been lightly edited for clarity.

‘There's so many cross-border criminal groups between the U.S. and Canada that collaborate’

Sam Cooper: Thanks for doing this. You know I spoke with Dr. David Asher about the TD Bank ongoing investigation, and his strong belief that global Chinese crime leadership and community in Toronto is driving the use of that bank in the case. And we spoke about the impact of Mexican cartel terror designations and how that could revolutionize these legal impediments in Canada like Stinchcombe and the rules that force Canadian police to turn over sources and intelligence to the gang defense lawyers.

Senior US Expert: With TD Bank, the thing in your piece I have been thinking about, is the U.S. banks and how many U.S. banks have exposure and what they failed to do—and the fact that the reason why TD has so much exposure is because of where the branches were and who was laundering money through Chinese organized crime. Listen, the laws in Canada are clear in your article—your piece with Stinchcombe, Jordan. I mean, I can tell you this historically: with the DEA Special Ops Division, and we had the Mounties physically with us—it was the intel side that was there. They couldn't share the information to the operational side. So here it is. You have this unbelievable information—investigative information—towards criminal networks, but you can't really use it.

It makes no sense. And it was hugely problematic. There's so many cross-border criminal groups between the U.S. and Canada that collaborate, coordinate daily. We know this. There's groups that are receiving fentanyl pill press operations—that are doing this in New York City but are also in Canada. And they have roots in both countries. And we know this. It's not something where this is a leader’s conjecture or speculation. No, this is actual investigative information.

Sam Cooper: To be clear, these are Chinese groups operating in Ontario and New York, for example, with no division?

Senior US Expert: Yes. Think about it like this. In China, everyone thinks, "Okay, well, chemicals, yes." You think, okay, yes, they're the biggest precursor chemicals in the world, right? But it's more than just that, right? They're also, in the U.S. and in Canada, they're amongst the biggest organizations for money laundering. They're also the biggest organizations for black market marijuana. They're also integral in setting up these criminal operations. Let me explain. If I'm receiving fentanyl, whether it's from China or it's from Mexico, and I want to distribute that on the street, I need a pill press machine. I need excipients. I need binding agents. I need guys. I need all these tools of the trade to be able to press that kilo with 100, 200, 250,000 pills. That's all coming from China.

Before it was fentanyl, you could go into most heroin mills, and the glassine bags, the stamps to market the heroin, the rubber bands—everything—from China. So it was not only just the most obvious. It's also the stuff that's not so obvious that the Chinese are involved in. They're way upstream on producing the chemicals. But also all the tools of the drug trade come from China.

Sam Cooper: So what this is—China controls the whole fentanyl economy, they produce the whole factory and it is distributed into North America.

Senior US Expert: Right. Precisely. And then when you come way down, right—the drugs getting distributed—and all the money's getting aggregated there too. So they're on both ends of the drug trade. And who are the Chinese way up at the absolute top of the enterprise? Guess what—you got People’s Republic of China officials way up top, and Chinese Communist Party also way down here on the street. Same thing. So China is on the front end and on the back end of the entire fentanyl system.

Sam Cooper: So let me sum this up, what I’ve gathered from experts like David Asher and yourself, what I heard from an RCMP expert aware of the State Department’s view, there is a really strong indication that China and the Chinese Communist Party have a strong influence over Mexican cartels.

Senior US Expert: Well, the cartels are dependent on China and CCP chemical production. So there's no question. That's very clear.

Sam Cooper: David Asher speaks very strongly about US investigative belief that the command and control for this Western Hemisphere money laundering goes to Chinese crime in Toronto, and that concerns TD Bank. What do you think about that?

Senior US Expert: The lessons that we learned—you talk about TD Bank. TD Bank was one of the most prolific banks in regards to money laundering in the last decade, right? The investigation that exposed TD Bank, we have full understanding of that. A lot was achieved by Special Operations and the New Jersey Division. Really, New Jersey Division was the lead. But the TD branches were in New York. Just to give you a little bit of color, Sam. And what we realized quickly was that branch employees were complicit.

How it works is that you have these systems within the bank that for their regulatory compliance, they are filling out some suspicious transactions reports for US Treasury and FinCEN. But are you really doing compliance? Are you really looking into the bank, into the branches for criminal exposure? One of the issues that we noticed is how young students—Asian students—are able to move millions and millions of dollars through TD. How does a one 22-year-old person move millions of dollars in cash into a bank? Yes, you'll have a bank that will say, "We'll issue a suspicious transaction report," but the bank accounts stay open without a request from law enforcement to look into this major suspicious activity. They stay open. So that tells me that compliance is secondary. You follow? And it's not a priority. But $3.1 billion makes it a priority after the DOJ takes an interest. But what does Canada do on their side?

Sam Cooper: The fine from Ministry of Finance is I believe $9 million Canadian dollars.

[On May 2, 2024, Canada’s financial intelligence agency Fintrac levied a $9.2 million penalty against TD Bank for major failures in anti-money laundering and anti-terrorist financing compliance. Violations included failing to report suspicious transactions, inadequate risk assessments, and neglecting mandatory safeguards for high-risk clients.]

Senior US Expert: It's so minimal. How far does that go as far as accountability, Sam? So think about what that means for those groups in Canada that are operating through TD.

Sam Cooper: So to break this down, one, you're saying that bank staff in New York are complicit in allowing the Chinese students to launder millions, which by the way, is totally consistent with the casinos in British Columbia. And you're saying, if I get you right, it would be the managers in Toronto who would have to care about the suspicious activity reports coming in and saying, we’ve got to shut that down—and they didn't.

Senior US Expert: There has to be a higher level of accountability or a higher-level system, and that's where TD failed. If you see one branch in Flushing, Queens compared to another—and listen, you are a regional director of these branches and you know that this is your hottest branch that's bringing in more money than any other branch—and you're not looking into it. Why? What's going on? Then that right there—and this is the language that was in the DOJ indictment: "inadequate compliance." In other words, they did the minimum compliance, but it was not adequate. That was very clearly the problem for TD.

Now, Sam—and don't get me wrong: U.S. banks are in the same boat. Don't think that Chase, Wells, BofA don't have exposure in this space. They do. The question is: where is their compliance? Is their compliance limited to the branch? Are they looking at it from a regional perspective? Are they trying to build in these robust compliance programs? I think the issue is you can no longer put that aside and hope for the best in case the government comes after you. I think that it's already pivoted. What David Asher told you about criminal charges—I think that's certainly on the table.

The designation of the Mexican cartels has transformed what the national security focus of the United States is going forward. So any industry that ties to those criminal groups needs to take a hard look at their holdings and their client base. And keep in mind, there are many organizations—it's not limited to banks, right? There's transportation companies, there's express mail service providers. There's a whole host of other industries that have exposure as it relates to now terrorist groups. Banks are the big one because that's where the money's at. But any industry that, whether knowingly or unknowingly, is crossing business with the cartels, they have serious exposure in regards to terrorist charges and material support charges.

Sam Cooper: So with regards to the Canadian banks, you had said that it's their proximity or exposure to senior Chinese organized crime which you believe makes TD so vulnerable in Toronto?